Find the Answer to 2 Questions Right Now

1.) What's wrong with the 401K?

2.) Will income taxes be Higher when I Retire?

JOURNAL OF THE SENATE

Michigan State Legislature

[June 15, 2017] Pages 829,830

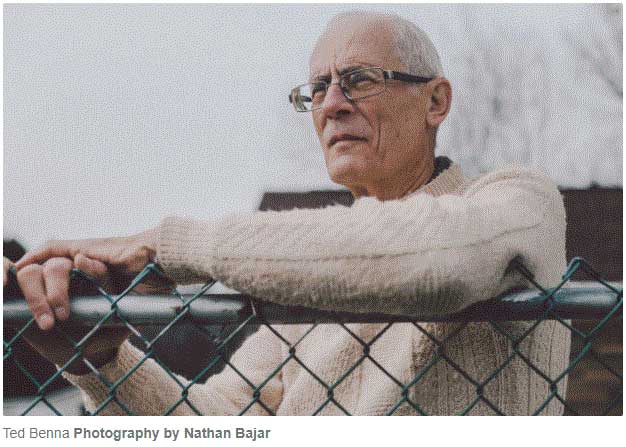

"Ted Brenna is a name many of you might not know, but Ted Brenna is the inventor of the 401(k) plan. He was a very Christian man. He came to the financial services industry with strong principles, and he said later in life that the 401(k) that he provided the backbone for, in doing so, he created a monster; that 401(k) plans had grown so overcomplicated and so fraught with hidden fees and opportunities for bad decisions that they were better at enriching the financial industry than the actual savers. He ended up leaving the financial sector and went back to a Christian college.

Before he died, Ted Brenna said he wanted to make sure it was really clear to folks that the 401(k)-style investment plan was meant to supplement retirement dollars, not to supplant retirement pension benefits for our retirees. They were supposed to supplement, not supplant."

FACTORS ERODING YOUR 401K/IRA RETIREMENT PLAN

LOW AVERAGE RETIREMENT SAVINGS

The average retirement savings of workers 60 to 64 with a 401(k) is $195,200. If you plan on living till age 88, that would get you 28 years of retirement. Your monthly draw before taxes would be $581 per month. After taxes, that's only $383 per month?

AVERAGE RATE OF INFLATION

The "Silent Killer" of your retirement savings is the Average Inflation Rate which over the last decade has averaged around 2.5%. The gallon of milk that costs you $3.75 today will cost you $6.79

INCOME TAXES AND MANAGEMENT FEES

Income taxes, penalties and 401k management fees can eat up 50% to 70% of your 401k retirement savings.

SOCIAL SECURITY

Social security is limited and it only replaces approximately 40% of the average worker's paycheck. There are no guarantees it will maintain that rate in the future forcing you to rely on your 401k or IRA retirement plans.

HEALTH AND CARE EXPENSES

In 2017, the median national cost for a semi-private Nursing Home Room was $7,148 per month. A Home Health Aid costs $4,100 per month. Medicare does not cover these expenses. Consider purchasing Long-Term Care Insurance.

MARKET LOSS

The Great Recession (jokingly) turned Americans’ 401(k)s into 201(k)s In the final two quarters of 2008. In 2008, those aged 30-50 had a median return of -30%. Over half of people over age 60 with 401(k) and IRAs lost more than 20%, according to Hewlett.

After Watching the Videos...

It's Time to Answer Question #2

SO WHAT IS THE SOLUTION?

GET TO THE 0% TAX BRACKET

With a Low-Cost Indexed Retirement Strategy

If you are like Americans, you’ve saved the majority of your retirement assets in tax-deferred vehicles like 401(k)s and IRAs. What do you do when tax rates go up after retirement? How much of the hard-earned money you saved will you really get to keep? Unless you can accurately predict what tax rates will be when it comes time to take that money out. It will be too late by the time you realize, your retirement account was nothing more than a tax bucket for Uncle Sam.

So what’s the solution? Position yourself for the zero percent tax bracket utilizing an indexed retirement strategy. Why? Because who cares what the tax rate is when you are in a zero% tax bracket.

HOW TO GET MORE INFORMATION

Connect With Us In a Couple Easy Steps

01

Contact Options

Use the "Contact Me" button below and let us know how and when to contact you.

02

We'll Call You

We'll call shortly after receiving your request. We return calls 7 days a week 8am - 9pm PST.

03

Retirement Review.

Have ready any current 401k, IRA, Investment or other retirement account statement(s).

04

Tax-Free Retirement

After your account review, we'll begin setting up your low-cost indexed retirement account.

CLIENTS SPEAK

Read about the other success stories

“ The office is very professional just like the people that work here and they are super helpful and will give you financial information to better prepare yourself. "

“ were very helpful and understanding of our financial needs and goals. They made us feel like they really cared. Thank you OmegaRetirement.com!”

GET IN BEFORE TAXES GO UP

DON'T GET HIT BY THE TAX TRAIN

We'll call you.

Let Us Know What Time and When...

A small sample of our 40+ carriers